I. Production:

Total area: 115,000 hectares.

Average yield: 7.5 tons per hectare.

Fresh tea output: 860,000 tons.

Finished tea output: 170,000 tons.

II. Consumption:

Official export: 121,000 tons.

Informal export: 6,000 tons.

Domestic consumption: 45,000 tons.

III. Total Revenue:

Official export revenue: $210 million USD.

Informal export revenue: $12 million USD.

Domestic consumption revenue: $315 million USD.

Total industry revenue: $537 million USD.

IV. Highlights of Tea Export in 2023

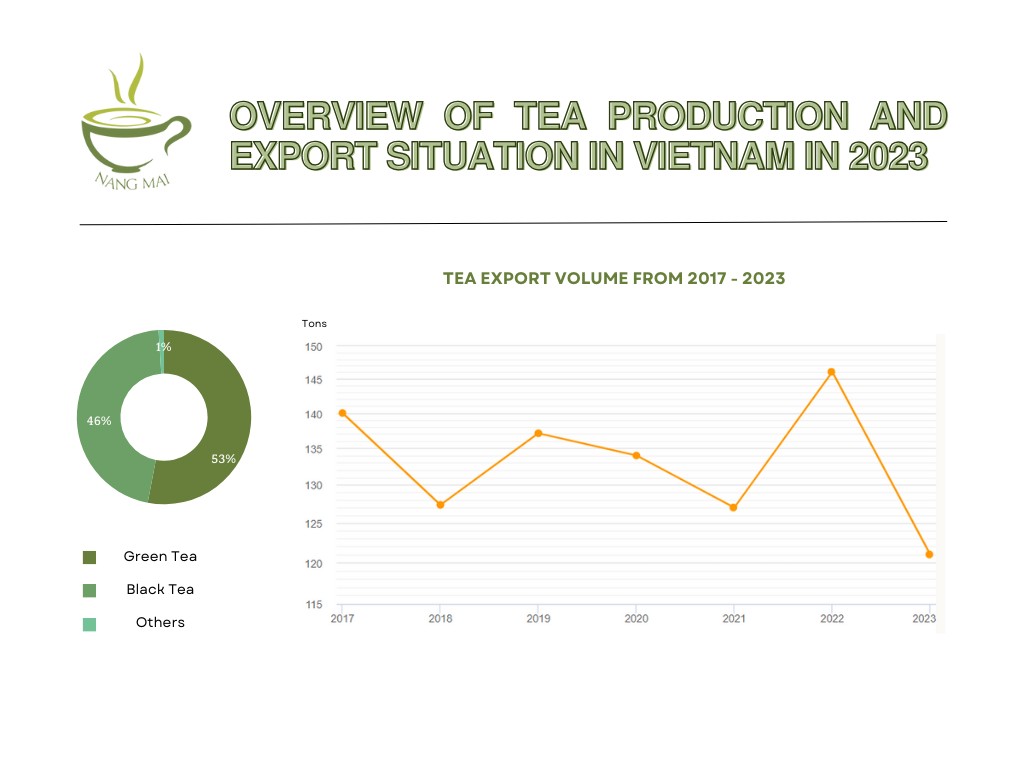

Overall, in 2023, official tea exports reached 121 thousand tons, worth $211 million USD, decreasing by 16.9% in volume and 10.9% in value compared to 2022. The average export price of tea in 2023 reached $1,737 USD/ton, up 7.3% compared to 2022.

Export product structure: black tea accounted for 46% in value, green tea 53%, and 1% other types, involving 260 companies and individuals exporting to 70 countries and territories. Pakistan, Afghanistan, Taiwan, Russia, China, and Indonesia remained the top 5 largest markets for Vietnamese tea, accounting for over 70% of total volume and value, followed by the markets of the United States, Iraq, Malaysia, Thailand, India, Iran (Islamic Rep.), and the United Arab Emirates…

Tea export prices in 2023 increased most significantly in the Indian market, up by nearly 30% compared to 2022, followed by China with 17% compared to 2022, Malaysia market increased by nearly 8%, and the Pakistan and Afghanistan market increased by 7% compared to 2022. In addition to the mentioned increasing markets, there were significant price decreases in markets such as Iran, down by nearly 25%, Iraq decreased by nearly 10%, Indonesia decreased by 5%…

The main factors leading to the decrease in Vietnam’s tea export activities in 2023 were weak market demand and increasingly stringent import regulations in the main tea export markets. Tea exports to major markets such as Pakistan, Taiwan, and Russia all declined due to economic difficulties. Pakistan’s foreign exchange shortage has prevented many of its importers from acquiring the necessary currency to pay for tea exports.

Furthermore, the global demand for tea consumption has shifted from conventional tea products to deeply processed, specialty tea products. This has posed challenges for Vietnamese tea products as they have been slower to invest in deep processing and conduct less research on new products.