This week, sea freight rates from Shanghai (China) to the UK increased to $10,000 per 40-foot container, four times higher than last week’s level of $2,400.

MSC, the world’s largest shipping company, recently increased container shipping rates from India by 30-40%.

By the morning of December 21, a total of 158 container ships were diverted from the Red Sea. These ships are transporting millions of containers of goods, with a total value of $105 billion, according to estimates by MDS Transmodal. The rerouting down the Cape of Good Hope, experts say, increases journey times by 7-14 days to reach Europe and 5-7 days to reach the East Coast of the US.

The main reason is the attack on the Red Sea recently. A representative of the Houthi movement in Yemen said that this force can conduct attacks about every 12 hours. This force will only stop its attacks if Israel ends its military campaign in the Gaza Strip and allows food, medicine and fuel to reach the besieged Palestinian people in this territory.

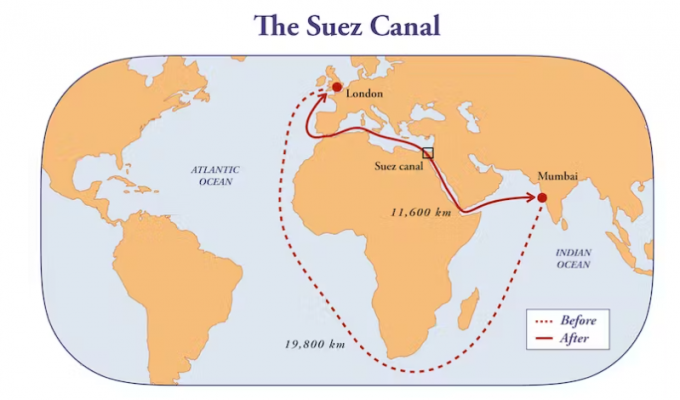

The Red Sea connects to the Mediterranean through the Suez Canal, forming the shortest shipping route connecting Europe and Asia. About 15% of the world’s shipping traffic passes through this canal and over USD 1 trillion in goods pass through annually.

A significant number of shipping lines have put a halt to their voyages through this critical maritime corridor due to the ongoing attacks. Here’s an overview of the latest developments and their anticipated effects on the global shipping industry.

1. Major Ocean Liners Rerouting

Companies including MSC, Maersk, and Hapag-Lloyd are avoiding the Red Sea route due to security concerns. They adjust route direction via the Cape of Good Hope, and could prolong voyages by 2-3 weeks.

The immediate direct impact is the losses in insurance costs due to route adjustments and cargo delays. It is estimated that the cost for a large ship carrying crude oil to pass through the Suez Canal from Europe to the Middle East has increased by 25% in a week.

2. Possible Impact on Ocean Freight

The ocean freight increases significantly (especially routes connecting Europe and Asia countries) and has a marginal impact on most consumer prices. On the other hand, oil prices could go up if more energy companies follow BP and stop using the Suez Canal, especially if this disruption persists over time.

Maersk said late on Thursday that additional payments include an immediate transit disruption surcharge (TDS) to cover extra costs associated with the longer journey as well as a peak season surcharge (PSS) from Jan 1. In total, a standard 20-foot container traveling from China to Northern Europe faces an extra charge of $700, consisting of a $200 TDS and $500 PSS, Maersk said. Containers bound for the east coast of North America will be charged $500 each, consisting of the $200 TDS payment and a $300 PSS, the company added.

CMA CGM also announced surcharges late on Thursday, including an extra $325 per 20-foot container on the North Europe to Asia route and $500 per 20-foot container for Asia to the Mediterranean.

3. Future Market Changes and Concerns

Longer and faster routes may lead to increased carbon emissions.

More than 3,000 extra nautical miles will be taken by vessels using the Cape route, which could generate around 30-35% more carbon emissions than if these ships were sailing the Suez route. The shipping industry already creates 3% of global emissions.

The changes in shipping routes and the associated delays are anticipated to have a ripple effect, not just on cargo via the Red Sea and Suez canal, but on a more global scale, potentially affecting consumer goods supply, especially with the upcoming Chinese New Year, and could drive up prices for consumers.